I finally registered as a self-employed professional, which means, I will have to file and pay the monthly percentage tax (3%), among other payables. It’s kind of frustrating knowing that in my job as an online English tutor, my salary already gets deducted by 10%! However, in preparation for possible future travels that involve visas, I thought it was high time for me to do this. Adulting is hard huhu!

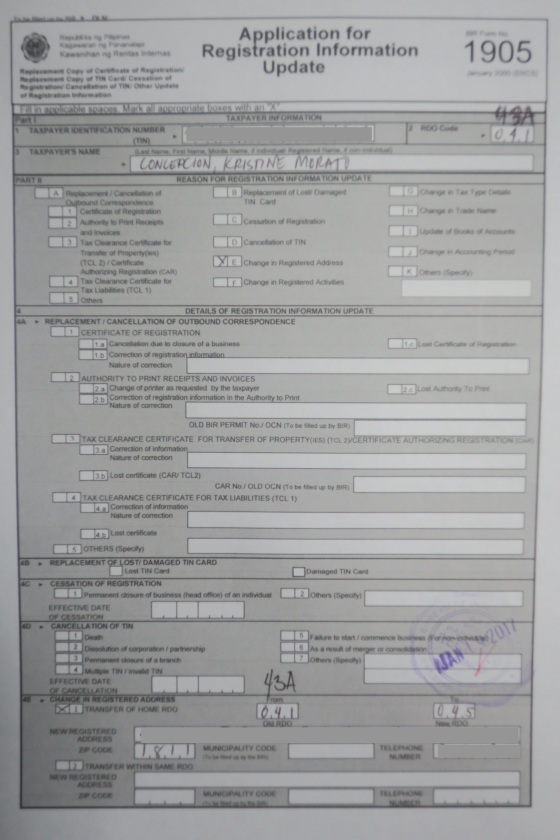

Anyway, because I was employed for a few months before discovering RareJob, I first had to change my RDO – Revenue District Office. I did this on January 19, 2017. I prepared 3 copies of BIR form 1905 (Application for Registration Information Update) and for good measure, photocopies of 3 valid IDs as well (although the BIR staff didn’t ask for such, basta bring them nalang, just in case). I asked a former colleague from the finance department, and she said our old company’s RDO was 041 (Mandaluyong), but it was actually 43A (East Pasig, along Shaw)! Don’t be like me, guys! Make sure you have the right RDO to save time, money, and effort! Imagine, I spent almost 5 hours on the road just to get a stamp, which was completed in just 5 minutes! Ah well, lesson learned.

To ensure that the change in RDO had already taken effect, I waited for a week (January 26) before going to my new RDO, 045 or the Marikina RDO. If you’re driving, don’t park within the RDO premises as you’ll have difficulty in getting out later. It is advisable to park on the sides of the road or maybe at the parking area of Blue Wave Mall, then just walk a little bit.

I was early, so when I got my computerized number (under “COR”), I was second in line for counter #2. When it was my turn, I presented the following documents:

Stamped BIR Form 1905 (original; they will provide a photocopy, wherein you’ll need to fill in just your name, TIN, and signature)

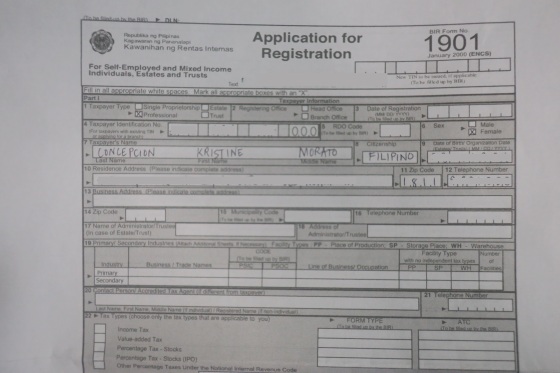

BIR Form 1901 (Application for Registration; 3 copies as well)

RareJob Tutor Agreement (you can only view this if you’re already an RJ tutor; this is proof that we are contractors, not employees. The PDF link is on the bottom of the page)

Photocopy of my birth certificate (I brought the original, but the BIR lady returned it to me, so bring it pa rin just in case)

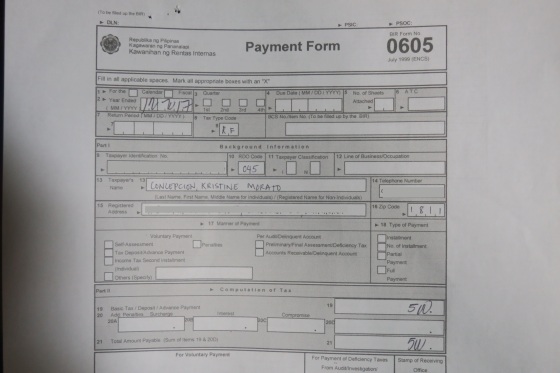

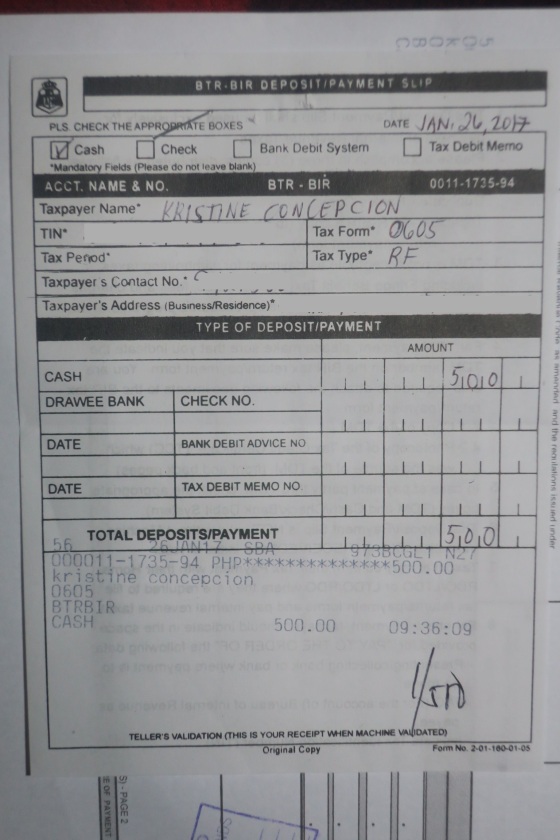

The BIR staff reviewed my documents, compiled them, gave me a few pieces of paper that looked like checklists, and asked me to fill in a form or two. She also checked my Form 0605 and input the registration fee, which is P500. Take note that new registrations and renewals can be done without any monetary penalty until January 31. If you fail to do so, there is a fine of P1,000, which will need a SEPARATE 0605. I was then advised to go to the “Officer of the Day” at the “ONETT” or “one time transaction.” You also need a computerized number for this, so make sure to get one before going to the separate ONETT room. When my number was called, the officer checked the docs and signed one of the checklist-like forms.

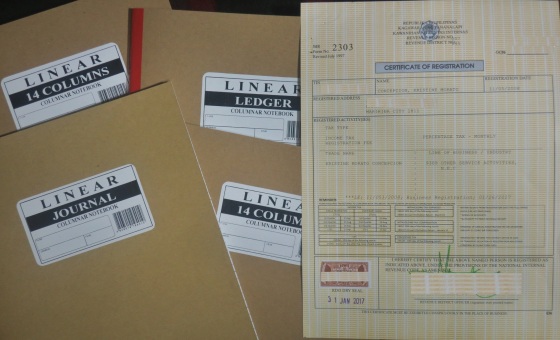

As instructed by the counter #2 lady, I then went to the nearest accredited bank, which happens to be the BPI branch beside Save More Supermarket. It’s just a 5-minute walk from RDO 45, even less if you walk fast (I took my sweet time haha). I informed the guard that I will be doing a BIR-related transaction, and he gave me the corresponding deposit slip. I got a number from BPI’s BEA (Express Assist), waited for a while, submitted all copies of Form 0605, and paid P500. I was given back one copy each of Form 0605 and the BPI slip, which is now the official receipt. Make sure to have them photocopied – get 2 copies. There is a photocopying machine beside the ONETT room. I went back to counter #2 – I didn’t need to get another number because the BIR lady said so; just approach her counter lang daw once payment has been settled. She got all my docs, including a photocopy of the completed 0605 with the BPI OR and told me that I could already get my COR (Form 2303 – Certificate of Registration) the following day. However, I had to be somewhere else, so I returned on January 31.

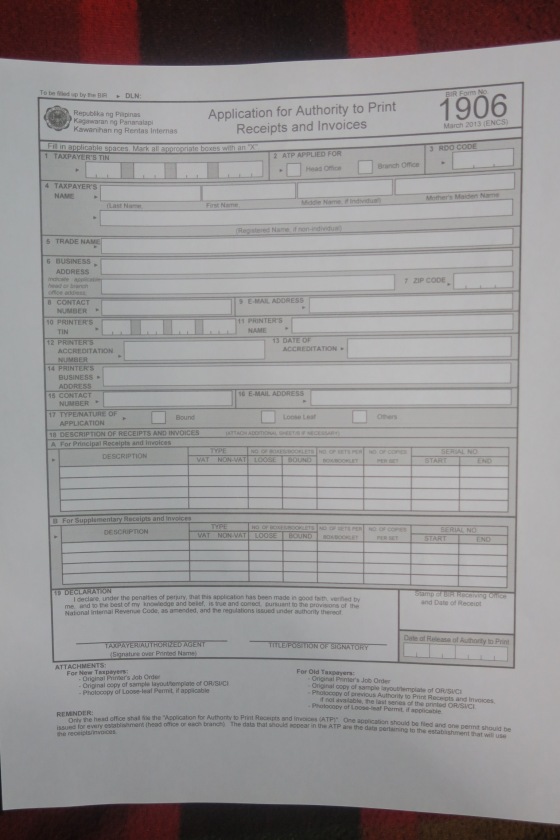

I was early again! 🙂 I presented the original copy of Form 1901 and submitted another photocopy of Form 0605 with the OR. I was asked to sign twice upon the release of my COR (they’ll ask you to check the details first). I then paid P15 for the documentary stamp, which was pasted on the lower left corner of the COR. Next, I completed 3 copies of Form 1906 – Application for Authority to Print Receipts and Invoices.

It’s mandatory for my tax payer type to also register for and have 4 books of accounts: journal, ledger, cash receipts, and cash disbursement. I paid P200 for these, and I was told to get a number (under “Books of Accounts,” if I recall correctly) – counter #3. While waiting for my turn, I had to write my name, business name (also my name), and business address (my home address) on the first page of all the books. The lady at counter #3 signed them and made me label each one, and apparently, they are valid for 3 years. I am supposed to write down my expenses and other financial transactions, but I have yet to fully understand how these work.

One thing left to do is to have receipts printed out, so I went back to counter lady #2 who gave me the option to have them made via her contact, which I accepted since I don’t know where else to get them. I will come back for the receipt booklets in 2 weeks. I was a bit shocked, though, as I’ll be paying P1200 for 10 booklets, which are good for 5 years. Ah well.

Before leaving, I was instructed to attend a seminar, which happens every Thursday at 9am, at least, in RDO 045. I will update this post as soon as I can or if I learn something new. Hope this is detailed enough for my fellow RareJob tutors!!! 🙂

I had help, by the way, thanks to Tutor NikkiB’s blog, which has a lot of entries about her tax adventures. I also did my own research and consulted with some CPAs and a lawyer about this. It sounds daunting at first, but the registration process is actually easy, especially if you have the complete documents and requirements. 🙂 The “real” ordeal begins when I start paying the monthly & quarterly taxes, but with the help of our fellow tutors, I know we can all survive this taxing aspect of being a home-based self-employed professional! Ganbatte! 😀

p.s. not yet a RareJob tutor? Join now! 🙂

Book of accounts?! I thought I’m done with accounting stuff already 😦 BTW, about the business name, is there a need to file something with DTI? And the receipts grabe 10 booklets! Andami ha!

LikeLike

Re DTI, in my experience, walang mention si BIR staff kahit isang beses. However, may ibang tutors na nagsabing pinapag-DTI nga sila. I guess it depends on the RDO. Oo nga eh, nagulat din ako, pero sabi ni ate, minimum of 10 booklets daw kasi talaga.

LikeLike

This is very helpful! Thank you! 🙂

LikeLike

Welcome 🙂

LikeLike

This is so helpful thank you! I just want to ask regarding the Book of Accounts, did you buy them at the BIR office directly or can you buy them in a bookstore too?

LikeLike

Hello! I bought mine at BIR na, ayoko na kasi ma-hassle hehehe

LikeLike

Hi teach! thanks for this! very helpful. Ako naman I’m thinking (pero urong-sulong pa due to money issues) na mag file na talaga not for travel / visa reasons pero baka need sa scholarship grant ng kiddo ko. University level na kasi sya by 2018 June. Sort of to prove lang na hinde malaki ang income ko at sigle mom ako kaya we seek financial educational assistance for college education. Yes narinig ko nga yang DTI registration kaya umurong din uli ako kasi ang laki na ng gastos. Meron pa nga pati Mayor’s Business Permit depende siguro sa RDO or sa city where the tutor resides. Imus, Cavite ako. Teach never pa ako nag file pero 5 yrs na ako with RJ this April 2017. Wala bang penalties? Or next year na ako mag file January 2018 siguro para fresh start tsaka hindi mahaba pila. What do u think? Thanks in advance mwaah! — Tita Marissa

LikeLike

Hello po! Yes po, mas okay na sa January 2018 na lang kayo magregister. No penalties unless dati na po kayong declared as a tax payer tapos di kayo nakapagbayad regularly. 🙂

LikeLike

Hello teach. Thank you so much for this! Btw regarding sa reply mo sa taas, may idea ka ba kung mgkano ang penalty if in my case, I worked at several call centers before and then hindi nkapagfile sa BIR since I started working in Rarejob 2 yrs ago? Thanks!

LikeLike

Bale po after ng last call center employment nyo, never pa kayo nagdeclare na self-employed na kayo? In that case po, walang penalty unless hindi na-update ng last employer nyo ung BIR status nyo. Normally po kasi, pag may nagresign, inauupdate nila ung list. Kung updated naman, ibig sabihin, sa records ng BIR , unemployed po kayo for the past 2 years, which means no penalty rin if you decide to register next year.

LikeLike

Pingback: 2551M: Monthly Percentage Tax (Amendment) | What The F!

Hello! Where did you buy your books of accounts? What store and exact location? I’ve been looking for it in national bookstore but they don’t have the linear brand. They just have valiant brand but, no more stocks for journal and ledger. Hope to hear from you! 😊

LikeLike

Hello, I bought mine from my RDO 🙂

LikeLike

Oh! So they sell it inside their office? Or maybe just in the specific RDO you visited? I wish my RDO sells it too. Thanks so much for the info! 😊

LikeLike

I forgot to reply to this pala! Hehe, depende siguro sa RDO or sa makausap mo from BIR. 🙂

LikeLike

Hi Tutor KC! I’ve been teaching at RareJob since 2013 and I haven’t started filing yet. Would it be wise for me to just register as a self-employed this coming 2018 para walang penalties? I’m worried po talaga. Hehe.. pero pasaway kasi.

LikeLike

Hello! How long na po kayong nagteteach bago magregister sa BIR as self-employed? Ako po kasi since 2013 pa and I haven’t filed my 2307s yet. I’m kinda worried na baka pag pumunta ako ngayon sa BIR, I would face a lot of penalties. Any advice po? Many thanks! – Yvonne

LikeLike

Hello! 🙂 I’ve been teaching since September 2014, then this January ako nag register. No worries, wala kang penalties as long as never ka nagdeclare before na self-employed ka. Or kung may employer ka before, dapat nun, inupdate nila ung BIR nila to inform them na hindi ka na employee, which means ang status mo dapat ay parang unemployed. Yes, mas ok na sa January ka na magregister. 🙂

LikeLike

Hello again teach! Sorry po makulit. Hehe. Meron po bang lumalabas na open cases sa BIR nung nagregister kayo? Yung sakin kasi, since 2013, apat yung open cases dahil hindi daw po ako nakapagfile ng ITR annually.

LikeLike

Hello again teach! Sorry po makulit. Hehe. Meron po bang lumalabas na open cases sa BIR nung nagregister kayo? Yung sakin kasi, since 2013, apat yung open cases dahil hindi daw po ako nakapagfile ng ITR annually.

LikeLike

Hmmm hindi ko naitanong yan, pero as far as I know dapat wala kasi nga kakaregister ko lang nitong 2017…

LikeLike

Omg! I don’t know why, pero may lumalabas yung sakin pero hindi pa naman ako nagregister.

LikeLike

Hindi ko na rin alam, I think sa BIR ka na dapat magtanong… when I registered, wala namang sinabi sa akin, not sure if sa separate department pa dapat itanong un, but ayun, as far as I know, wala talaga sakin… good luck!

LikeLike

I see. Yes, I better ask them na lang. Just terrified of the probable penalties though. Huhu

LikeLike

Hi! I am an RJ tutor. Every month may withholding tax 10% ako. May babayaran ba na percentage tax every quarter aside sa monthly withholding tax? Hm po?

LikeLike

hello, I am assuming that you are not a registered professional since you are getting taxed 10% monthly. Please ask RJ and your RDO…

LikeLike

Hello! I’ve only just begun studying about paying taxes as a freelancer, and it is thanks to bloggers like you that makes it easier (even if the process is still daunting).

My need of clarification, however, is the same as most of the comments here: regarding the post-January 31 penalty. My situation is this:

2012 – 2014: Worked for a company; they were the ones who paid my taxes to BIR as an employee.

End of 2014: I got laid off, so bye-bye full-time job.

2015 – 2017: I went back to school to get another degree. I never touched nor even cared about my tax status at this point.

End of 2017: I’m about to graduate BUT I plan to work freelance for a while.

Now that I want to freelance, I am planning to change RDOs and update my status THIS WEEK. If ever my previous company had indeed updated by BIR status into unemployed (like what I read from your previous comments), would you know the cons of updating now that the year is about to end? Or would you recommend that I just wait out until January 2018 to update my records?

Thank you so much, teach.

LikeLike

The only con I could think of is the penalty fee, which is at least 1K… It’s better to wait for January 2018, IMO. 🙂

LikeLike

Sis question, ung 1901 and 065 Form po ba ay makukuha once na file mo na ung 1905 change if RDO?

LikeLike

Downlodable, afaik 🙂

LikeLike

Hi question lang, kung mag re-renew ba ng 0605 registration kailangan i file sya personally sa sariling BIR RDO?

LikeLike

No need to visit BIR for that, diretso na sa bank as long as di naman later 🙂 (January 31 ang deadline)

LikeLike

Hello. I have the same online job and I tried registering as a professional, too. I tried to check the box marked “Professional,” the way that you did. When I tried submitting it to BIR, however, I was told that Professionals should have licenses (PRC passers, etc), and that freelancers aren’t professionals. How were you able to register as professional po? 🙂

LikeLike

Everything that happened to me when I registered is already written here, so I don’t know why you weren’t able to do so. Maybe you should ask someone from BIR instead.

LikeLike

Pingback: Goodbye, Monthly Percentage Tax! | What The F!

Madam KC, I have a question.. RareJob renews the Tutor Agreement every November, right? So when is it best to apply for a COR, November or January?

LikeLike

The TA is renewed during your anniversary with RareJob. January is better.

LikeLike

Good evening, Ms KC.. Your post is one great help.. Thank you for this.. My concern po is that I have been working in an ESL company like RJ for a year na.. I wasn’t able to register as a Self-Employed sa BIR.. Is it too late po? I am planning to get an ITR form pa nmn.. Also, I will be moving to the province this May.. If I register next year January 2020, would I get any penalty po? My company deducts 5% on my salary for the Certificate of Creditable Tax Withheld at Source BIR Form No. 2307.. If I register po this month, how much will I pay?

LikeLike

Good evening, Ms KC.. Your post is one great help.. Thank you for this.. My concern po is that I have been working in an ESL company like RJ for a year na.. I wasn’t able to register as a Self-Employed sa BIR.. Is it too late po? I am planning to get an ITR form pa nmn.. Also, I will be moving to the province this May.. If I register next year January 2020, would I get any penalty po? My company deducts 5% on my salary for the Certificate of Creditable Tax Withheld at Source BIR Form No. 2307.. If I register po this month, how much will I pay?

LikeLike

I was working with RJ for 3 years already before I registered, but I did not get a penalty. It’s because after being employed, as far as BIR records show, all they know is I had been unemployed. I suggest you register na lang in 2020. But better na rin to consult the RDO of the place where you will move.

LikeLike

I see.. Thank you so much po for answering.. . ❤ God bless you..

LikeLike

I’m sorry, but I don’t get it. What about RJ tutors who earn less than 20,000 pesos a month? As an independent contractor of RareJob, you are considered not an employee but a self-employed individual.

And the self-employed individuals are not required by law to pay or file for taxes if they earn less than the said 20k per month (about https://assets.rappler.com/612F469A6EA84F6BAE882D2B94A4B421/img/611AE733A3D74BF7BA4FB6664BAE02A1/tax-02_611AE733A3D74BF7BA4FB6664BAE02A1.jpg

Source: https://www.rappler.com/nation/191729-rodrigo-duterte-signs-tax-reform-law

LikeLike

Then please ask your RDO what to do.

LikeLike

This is very helpful! Thank you for this. I just have a question. Is it mandatory to attend the seminar. I have a friend attend one because she registered as self-employed but during the seminar out of 20 people siya lng yung nag oonline work. Everyone else had their own business or asked to attend because they franchised with Grab. She said it felt unnecessary for her. I was asked to attend (after registering) but the seminar will be held on Thursday when I have a very important meeting to go to.

Also, how many times do you file taxes? Ilan po ba yung kailangan i file pag tutor? Alam ko lng po kasi monthly and yearly? Kailangan po ba magfile sa BIR mismo or pwde lng online? I’ve been searching and the information is too overwhelming. I’m really new to this and I super agree..Adulting is HARD!!!

LikeLike

Attending the seminar: in my experience, it’s unnecessary nga because ang focus mostly is for businesses na company/corporation nga. But nasagot naman mga tanong ko nun, so ok lang naman.

Tax filing: depende ito sa classification mo. In my case, graduated 8%, I only file quarterly & yearly. Everything is done online via the BIR app, pero pag may kelangang bayaran, then need pumunta sa bank.

LikeLike

Currently I’m at 10% so I registered para mas bumaba. Does RareJob still deduct 10% monthly?

And regarding the book of accounts, have you figured them out? Are we suppose to use them? Will we need to get new ones every 3 years?

Thank you:)

LikeLike

AFAIK, 10% is the default deduction of RJ if you’re not registered… I have never used any of the books nor my receipts haha, I dunno nga what will happen with those eh…

LikeLike

Hi there tutor!

Have you tried renewing your tax classification na po with RJ? What requirements did they ask you to submit again? Thank you.

LikeLike

According to the tutor website (tutor fee > tax classification), you need to submit a copy of your COR and the original notarized sworn declaration. However, these are supposed to be submitted in January, RJ gave a deadline.

LikeLike

I got my COR last year December and just had my 0% classification this year after working with RJ for 3 years. I need to pay annually pala(every January) for COR. Will it matter sa renewal sa RJ if I don’t pay the annual registration?

LikeLike

It won’t matter to RJ, but it matters sa BIR. You’ll get a penalty if you fail to pay.

LikeLike

Good day!

Thank you for this very informative blog!

I have a few questions that I really need answers to.

I already e-mailed both the RJ support and BIR regarding this but I’m currently awaiting their reply.

Here’s my situation:

I worked as a REGULAR employee from 2016-2019. Then I transferred to a different institution as a CONTRACTUAL employee from 2019-2020.

I started working in RJ in May of 2020.

My questions is:

Am I still required to register and get a CoR even though I chose the 10% monthly tax deduction?

Thank you so much!

LikeLike

Tbh, I also don’t know the answer. As far as I know, if you chose the 10% monthly tax deduction, there’s no need to get a CoR. But yes, please wait for RJ/BIR’s answer.

LikeLike

Hi. Thanks for your beneficial blog. I hope you can answer my questions.

BTW, I just got hired by RJ this month 🙂

1. I have a COR because I was with Bizmates before RJ. Can I submit that to RJ, too?

2. Will it matter to RJ if hindi ko pa na-renew COR ko? (It says here it’s valid till Dec. 31, 2019?) tatanggapin ba to ni RJ?

3. Do I need to get a NEW Sworn Declaration? Meron akong old copy when I was still with Bizmates.

Thanks in advance, teach! God bless!

LikeLike

Hello, sorry for the late reply. Welcome to RJ!

1&2 —-> you have to renew your COR first at your RDO.

The Sworn declaration is submitted annually.

What I am not sure about is if mag-accept si RJ now ng documents from you because we were asked to submit ours last January, may deadline kasi.

LikeLike

Hi Khristine! I stumbled upon your blog when I was looking for how to fill up the 1901 form. I have been with Rarejob for 2 years now. I haven’t transferred my old RDO to my new one but I filed my annual taxes last year. What do you think would be the repercussions for this? Rarejob doesn’t help in assisting new freelancers on how to file properly so I had learned it recently. I thought I don’t need to register and just let Rarejob do the work. But now, I really need to register as a self employed professional. I have sooooo many questions. Can I email you??

LikeLike

Hi, I am not sure if I’m the best person to answer your questions since I am not an expert myself. Best po talaga to check with your RDO…

LikeLike

What taxpayer type do we online tutors fall into?

a. Single proprietorship

b. Professional – in general

c. Professional and proprietor

LikeLike

B

LikeLike

Hi. I’m a new tutor at RJ. I wanted to get a COR para less tax but I wanted to start teaching immediately so I opted for the 10% tax for now and renew it later. Question: Am I required to file taxes even though I don’t have COR yet? I taught at a different ESL company briefly before RJ but I did not file any taxes cause I presumed I didn’t have to if I was deducted 10% tax. Looking forward for your reply. 🙂

LikeLike

I am not sure, to be honest, but I think you need not file anything for now. But it’s best to ask TS about it to be sure.

LikeLike

Hello po Tut! I’m still a Rarejob tutor but might be leaving soon :(. I’m really grateful to be a part of it. I’m just curious if you already have a format heading for your books? I’m still lost actually on how what to write.

LikeLike